Underlying basics to candlestick patterns

So you want to learn about candlestick patterns to help with your trading? You think you have to learn all the different types and names right? Well relax ... you don't have too.

There are plenty of candle trading patterns. Here are their names;

The white candle, the black candle, shooting star, hammer,

inverted hammer, hanging man, doji, spinning top, marubozu or shaven

candle, short candle, long and dominant candle, bearish rejection,

bullish rejection, bearish engulfing pattern, bullish engulfing pattern,

dark cloud cover, piercing pattern, harami, harami cross, evening star,

morning star, evening doji star, morning doji star, two crows, upside

tasuki gap, downside tasuki gap, rising three method, falling three

method, tweezer top, tweezer bottom, upthrusts, springs, dominant white

candle, dominant black candle, ... plus others.

If you are interested in looking at these different patterns, Wikipedia shows all the simple and complex candlestick patterns http://en.wikipedia.org/wiki/Candlestick_pattern or go here.

To the uninitiated newcomer wanting to learn candlestick patterns

it may seem a little daunting. Some candlestick trading patterns are

known under different names, while others have been invented in more

modern times.

Learn about the basics of candle charts here.

These trading candle patterns seem to have their roots in the

orient, namely Japan. The concept was developed by rice traders back in

1500 to 1600 time period.

It is important to realize that these candlestick patterns are only guidelines. They are not 100% accurate, nor is anything else out there one hundred percent reliable. Remember, that these patterns simply move the odds in the traders favor.

The idea is to understand the psychology behind the price action.

Add this psychological understanding to your current trading system and you will see dramatic improvements to your profit.

The questions traders should ask themselves while using candlesticks are; "Why is this price pattern forming? What is it indicating? Does it show hungry keen buyers desperate to go long? Or does this price pattern show scared sellers desperate to exit their positions or desperate to go short? Or Does the formation of this pattern show indecision?" Let's take a look at the chart below ...

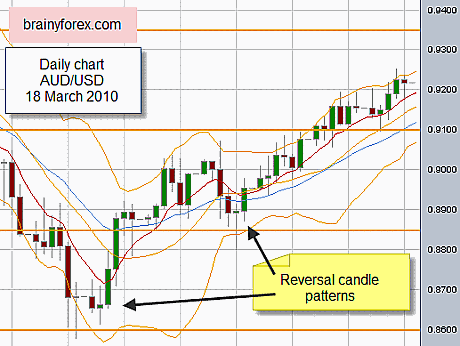

The above chart shows the Australian Dollar daily chart 18 March 2010.

Notice how in both cases (shown by the arrows), we first see big

red bearish downward price action, followed by smaller price range days

(no color) and then followed by Big green candles.

To restate we see, price on the daily bars go from closing the

day down ... to closing the day unchanged ... to closing the day higher

than opening. ie BIG RED, NO COLOR, BIG GREEN.

If price starts high in the day and finishes low at the end of

the day we can expect the same for the next day. This is because price

is being pushed downwards and who knows how long this will continue for?

Another day? Another two days? Another three days? Nobody really knows.

We can call this a bearish red (or black) candle. The more volume

(sellers) the more powerful).

The same principle holds true for price starting low at the

beginning of the day and then finishing the end of the day on its

highest point. This is a bullish white candle. We can expect more

bullish days to follow. But who knows for how much longer?

We can see that once these bullish or bearish daily candles start

weakening we can expect price to stall or retrace a little or retrace

fully depending on other factors.

Read more about the correct way to read a candle chart, go here.

Candlestick patterns work best when market trending

When the market is in a sideways pattern, bullish and bearish

candlestick patterns may not mean anything. The power in candlesticks is

when price is trending.

Use them on any time frame

Don't forget to use candlestick patterns on every or any time

frame. We can see what pattern price set based on yearly charts,

quarterly, monthly, weekly, daily, 4hr, 1hr, 15 minute, 5 minute etc

time frame. It is a good idea to check the candle patterns on the higher

time frames so as to confirm you are trading in the trends dominant

direction.

It's interesting to note that when Steve Nison started translating candlestick chart information from Japanese books he noted that most of the chart illustrations were shown on the "WEEKLY charts". Trading legend WD Gann encouraged trading speculators to use the 'weekly chart' as a major reference point as he believed that they were the most accurate. Read more about WD Gann here.

Orange lines on chart

Wondering what the orange horizontal lines represent on the above chart? They are 'secret' support and resistance levels that not that many traders know about. They are natural square levels. Read more here.