Must read article by TulipFX.com about your choice of currency trading broker

Talking about currency trading brokers ...

"We feel the true ECN broker charging a commission is the one type of broker that has the least incentive to 'mess with your trading'..." TulipFX.com.

With the permission of TulipFX.com, brainyforex has reprinted their

indepth article entitled "The Impact of your Choice of Currency Trading Broker on your

Trading Results". The article covers essential elements that all forex

currency traders need to be aware of.

Usually most traders

focus most of their efforts on the search for a good system or EA to get

optimal returns on their investment.

What most traders don’t

realize however, is that a good currency trading broker can have a large impact on those

expected returns. And as you’ll find out in this article, spending time

on selecting a good broker can certainly pay off. Big time.

Since

2007 there has been an explosion in the number of forex brokers

available to the retail trader. While there were only a few to choose

from four or five years ago now the number would be in the hundreds, if

not higher. While we are spoiled for choice, choosing the right broker

can still be daunting task.

When comparing brokers, traders tend to base their primary ranking on the following criteria:

1.Spreads

2.Commission

3.Type of broker: Dealing Desk, Straight Through Processing, ECN etc

4.Regulation

5.Customer service

No

surprise: the spread tops the list, as it’s a quick and easy way to

compare brokers. However, before diving into the nitty gritty of how

spread and price feed can influence your trading results, let’s start

with dividing brokers into two buckets first: Dealing Desk/Market Maker

brokers and the Non-Dealing Desk brokers. Because that’s where a lot of

trouble starts.

Dealing Desk / Market Maker Brokers

This

type of brokerage is probably the first to come to market. These

brokerage houses trade on their own equity (they have little or no

access to liquidity providers) and “make the market”. This usually means

they take the opposite of your trade on their own account.

For

example: the "Dealer" receives an order from you to go long, and if he

accepts your order he might take the short position or match that with

another order from another client who wants to go short at that time (so

their order book is ‘balanced’ and their own exposure is now reduced).

One of the main tasks of the Dealer is to ensure the broker maximizes profits and reduces its own exposure to a minimum. To maximize profits and reduce his exposure, the Dealer has access to numerous tools to manage his business and balance his orderbook.

In the screenshot above, you’ll see just one example of how the

Dealer can actually ‘manipulate’ your order. The Dealer can choose to

delay your order, reject it, or issue a requote and offer you a

different price. Note how they can increase price and spread at free

will.

The business model of these types of currency trading broker is simple:

maximize returns on spread, delaying orders, filling orders at different

price requests (requotes) to ensure the odds are even more against you.

Moreover, when the balance in the order book allows, they can initiate

stophunts by moving price up or down in quick spikes to trigger your

stops.

Below you’ll find screenshots from the [Undisclosed software developer] Handbook, showing the Quote tool.

As you can see [sorry censored], the broker (Dealer) can adjust the

spreads on a global level for each pair and add the spread to the

quotation flow in the price feed. This is called "mark-up on the bid",

and will alter the actual price feed and thus impact your EA results.

Can This Get Any Worse?

Unfortunately,

yes. For example, have a look at another tool brokers have at their

disposal, the ['name censored Plugin'], developed by [name censored],

the same developers that gave you [name censored].

With this

tool, forex brokers can stack the odds even more against you. They can

manually or automatically delay execution, slip your trades, trigger

stops and stopouts, and even –silently and temporarily (!) - adjust

your leverage to enforce a margin call.

But don’t take our word for it, have a look at the screenshots below:

If you’re interested in reading more about this, the complete PDF can

be downloaded [sorry removed due to trading software developer

request].

So How Do You Know What Your Broker Is Up Too?

Well, there is hope. Have a look at this video:

[SORRY VIDEO NO LONGER EXITS]

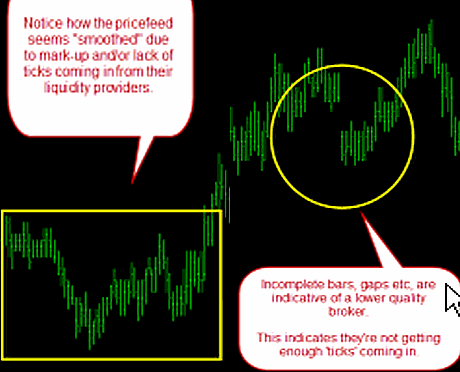

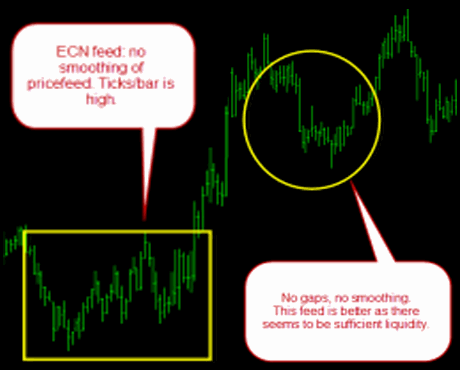

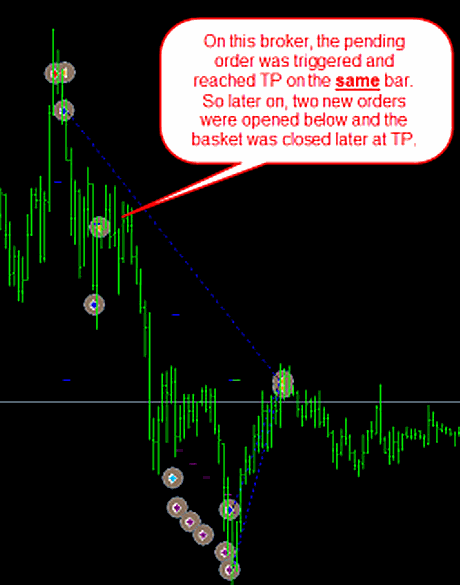

Now, how can differences in price feed impact our trading? Have a look at the screenshot below.

Note: On both brokers, Take Profit was hit and all positions were closed in a

nice total net profit. However, the first broker took just longer to

reach TP.

This is just one example of how price feeds that may

appear totally similar to the eye, can impact results rather drastically

when trading.

Demo Vs Live Accounts

Once

you’ve selected a good currency trading broker and you’re ready to test your EAs in

forward testing, you might be in for another surprise. As just about

everyone tells you in this business, you should test your EAs on a demo

account first. We agree with that to a certain point.

Have you

ever noticed that your EA makes tons of money on demo, you get all

excited, start dreaming about that new Porsche or sailing yacht, rush to

open a live account only to discover your actual live results are

completely different from what you first expected?

I think we can all relate to this situation from experience.

Here’s what happens.

First

of all, demo accounts do not suffer from lack of liquidity. So you

always get filled on the price you requested. No slippage. This is

especially true for the so-called Asian scalpers. They trade during low

liquidity times after NY close and before Asian open. On demo, all looks

fantastic, but on a live account, you will get slipped and this can

results in less profits or even losses.

Second, most currency trading brokers

don’t offer the same price feed for demo and live accounts. There might

be a difference in spread, or a slight delay of the demo feed, impacting

the way the EA trades.

So next time you put an EA on demo, make sure

the price feed is the same as the live account. Check with your broker,

and ask them about this.

And please do realize demo results will seldomly reflect your results on a live account due to slippage.

Honesty Is Such A Simple Word

Once

you have gotten your head around all the technicalities of a currency trading broker and

understand how the odds might even be more stacked against you than you

initially thought, the next series of questions that should come to

mind: Will my money be safe with this broker? Where does the currency trading broker

operate? Is the broker regulated by an authority which has a reputation

for being prudent and studious in its monitoring of brokers? That is –

is the broker regulated in the US? Britain? Australia? Or are they

regulated in Central America? Indonesia?

As a general rule,

the European Union, the USA and Australia offer the most rigorous

regulation. Russia, Central America are known to offer less strict

regulations. So stick to those regulated in well-regarded countries and

who display their license number on their websites. When considering a

broker, ask them for their license number and verify it. A Google search

can verify their claims easily.

Finally, when something does

go a bit wrong, you want good customer service. So test them out. Give

them a call, have a live chat and have a general conversation. Ask them

about regulation, any EA or trading restrictions, slippage, spreads

during rollover time, cost of carry (swaps) and deposit and withdrawal

methods and times. They should be happy to answer all those questions in

full.

A good point of reference before making the decision to

jump into bed with a broker is to check out the Forex Peace Army broker

review pages http://www.forexpeacearmy.com/public/forex_broker_reviews They have public comments from traders just like you and me.

OK So Now What?

We

feel we’ve covered a lot of ground here, and you might be more confused

now than you were when you first started reading this article. We

apologize if that’s the case and we’ll try to sum it up for you below by

giving you some pointers when selecting a broker.

Here’s the beef of what we consider important when selecting a currency trading broker.

Quick Broker Selection Checklist:

ECN broker, 5-digits, fees based on commissions

Fast execution, low spreads

Sufficient liquidity (ticks/second is high)

Regulated by reliable authority

Offers segregated accounts

Good ratings/feeback on FPA (ForexPeaceArmy.com)

Examples

that would fit this profile: Alpari (NDD/ECN account – not the micro

account), GoMarkets, Pepperstone, MIG Bank, ATC, FXPRo, etc.

Also interesting: FinFX but they’re not yet registered in Europe.

And

finally: Do your own due diligence..! Google for the currency trading broker. Read

feedback on forums. Participate in discussions. Demo the EAs for a while

on the broker platform and compare results with those shared on forums

or on sites that track accounts (MTI, myfxbook.com, etc).

We

hope we shed some light on the difference between brokers and the impact

brokers can have on your live trading results. So next time you’re

wondering why you ‘did not get that trade’ and your trading buddy did,

you might want to investigate your broker a bit more ...

As

one of our TulipFX team members always says: "You can get a Porsche, but

what good does it do if you can drive it on a dirt road only?"

Wishing you all the best in your trading, and we hope we clarified some things for you!

Dutch & Ozzie.

www.tulipfx.com