- Home

- Articles

- Forex Trading

- EURGBP Commentary 23 August 2013

EURGBP Commentary 23 August 2013

by Marcus Holland

(The Traders Resource)

EUR/GBP Commentary 23 August 2013

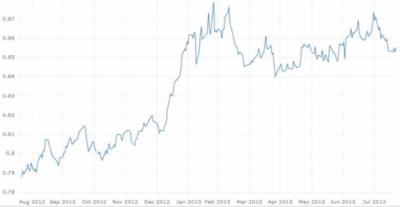

Since the beginning of the year, the euro and the pound sterling have been range trading between 0.84 and 0.88. This pair appears to be governed mainly by the frequency of news, with the recent talk of growth in Europe causing an upturn in the currency pair principally because news of sterling has been quite light.

Chart courtesy of Alpari.com. This upturn is not in accord with the general trend, which has been recently for a decline in the pair, given a stronger sterling. Despite this, there is strong support at the .8520 level and it will take a determined effort for the price to break downwards. This downward trend will be strongly resisted by recent events which have suggested that European growth is strengthening. Curiously, even the vaguely optimistic news that the euro zone will resist reverting to recession seems enough to influence the Forex markets.

In light of this, it appears that the chart may rise as high as .8620 before any sign of returning weakness. The pairing appears to be in oversold territory, and this may help to raise the level temporarily, before the pound strengthening forces the chart lower.

Nonetheless, in the long-term it appears that sterling will continue to improve. The fall in the EUR/GBP in July was due in part to the strong data concerning UK retail sales, and you can expect with further good news from the UK that the chart will decline. Current projections are that the UK economy will continue to improve, and given the disparate nature of the constituent countries of the euro zone, it is hard to believe that there can be a coherent and consistent recovery that will in the end allow the euro to prove stronger.

By Marcus Holland from The Traders Resource.