- Home

- Technical Analysis

- Technical Analysis Its Role in Forex Trading

Technical Analysis Its Role in Forex Trading

by www.mtrading.in

That history repeats itself may be technical analysts’ biggest belief; and they use it to analyze forex trends. Technical analysis plays a big role in a financial market that is mostly speculative.

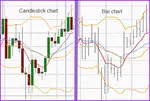

Technical analysis is a method of analyzing the statistics produced by market activities like past prices and movements. Technical analysts use the performance history of markets to serve as good indicators of its future performance. Unlike fundamental analysts who look at the value of the product, financial situation, and the corporation itself when finding out a business’ value, technical analysts need only to look at the charts and graphs that indicate the business’ performance to determine its value and future performance. Technical analysts believe that trends from the past tend to repeat themselves in the future.

Role in a Speculative Market

Dealers and traders can easily estimate market directions with the help of charts from past trades and compare them to economic and political news at the time of the rise or fall. When a similar event occurs in the future, they can somehow tell how the market will react to it.

Predictable patterns in market trends often get repeated over time. These patterns are called signals. Since market directions tend to repeat themselves, past market signals can be an indicator of a current market’s signals.

Technical Analysis vs Emotions

One of the biggest mistakes a trader can make is to base his or her trades on his or her emotions. Technical analysis can minimize a trader’s use of his emotions as basis for making decisions on a trade.

Traders may use mathematical studies, volume charts, and price charts to make a logical decision on a given situation. These tools may help identify a trend and also determine that trend’s stability over time. While there is no guarantee of success when using trends as basis for trade decisions, it can at least help a trader make objective decisions.

Technical Indicators

Technical analysts use technical indicators to determine how the market is performing. They use trend indicators, strength indicators, cycle indicators, volatility, support and resistance, and momentum to determine how the forex trading market moves and what the best action for a trader is.

As a speculative market, foreign exchange trading is greatly helped with methods like technical analysis. It is good that a method like this can be used to make logical and objective decisions to improve one’s trading decisions.