- Home

- Trading Strategies

- The Hull Moving Average as an Incredibly Fast Lag Remover

The Hull Moving Average as an Incredibly Fast Lag Remover

(www.admiralmarkets.com)

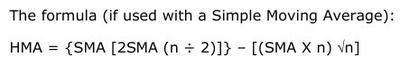

Hull Moving Average Formula

As a foreign exchange trader,if you plan on using analysis software, it’s suggested to opt for one that grants you access to a lineup of technical indicators that can up your trading career; for one, there’s the Hull Moving Average.

As a technical tool, it’s quite popular and according to many traders, it holds the record as the fastest lag remover. After determining the particular type of moving average, it reviews any given data and quickly removes lag, as well as other obstruction factors that can influence the analysis.

But, since it attained a high level of recognition as a reliable technical indicator, it gives you a hint that removing lag isn’t all there is to it.

HMA 101

The Hull Moving Average (or HMA) is a technical indicator that focuses on smoothing different types of moving averages; the list includes Simple Moving Average (or SMA), Weighted Moving Average (or WMA), and

Exponential Moving Average (or EMA). Along the process of improving the analysis of a technical trader, it is known to eliminate lag almost instantaneously.

It was Alan Hull who developed the Hull Moving Average in 2005. Back then, his primary objective was to address the common issue that caused technical analysts to scratch their heads when interpreting charts. He remains proud that due to his clever mathematical abilities, the results were far from disappointing; it meant that the age-long dilemma about lag was resolved.

Instructions

Using the Hull Moving Average can be a bit complicated; however, with careful analysis and computation, arriving at a value for the HMA can be accomplished. You simply need to be adept in spotting chart signals; you should also have a good grasp of arithmetic skills. The formula is shown on top of this article. Moreover, the calculation for the Hull Moving Average requires the values for a preferred type of moving average and a preset period. Once these figures are identified, you can begin the 3-step process. (1) First, find the value of the main dividend by first dividing the preset period by 2; multiply the quotient by the moving average, and, again multiply the product by twice the moving average, (2) next, find the value of the divisor by multiplying the moving average by the preset period; and, multiply the product by the square root of the preset period, and (3) lastly, find the value for the HMA or the quotient of the main dividend and divisor.