- Home

- Forex Articles

- What is prop trading

What Is Prop Trading? How Funded Trading Firms Work

What is prop trading? Prop trading, short for proprietary trading, is a way for traders to trade the financial markets using a company’s capital instead of their own money. Understanding what is prop trading helps traders see why these rules exist and how funded trading accounts are structured.

For a broader definition of proprietary trading, Investopedia provides a clear overview of how prop trading works in financial markets.

Rather than risking a personal trading account, traders work with a prop trading firm that provides funding once certain performance criteria are met. In return, the firm takes a share of the profits, while the trader keeps the rest.

For many retail traders, prop trading offers a practical path to trading larger capital without taking on the full financial risk themselves.

What Is Prop Trading and How Prop Trading Firms Work

Most prop trading firms follow a similar structure.

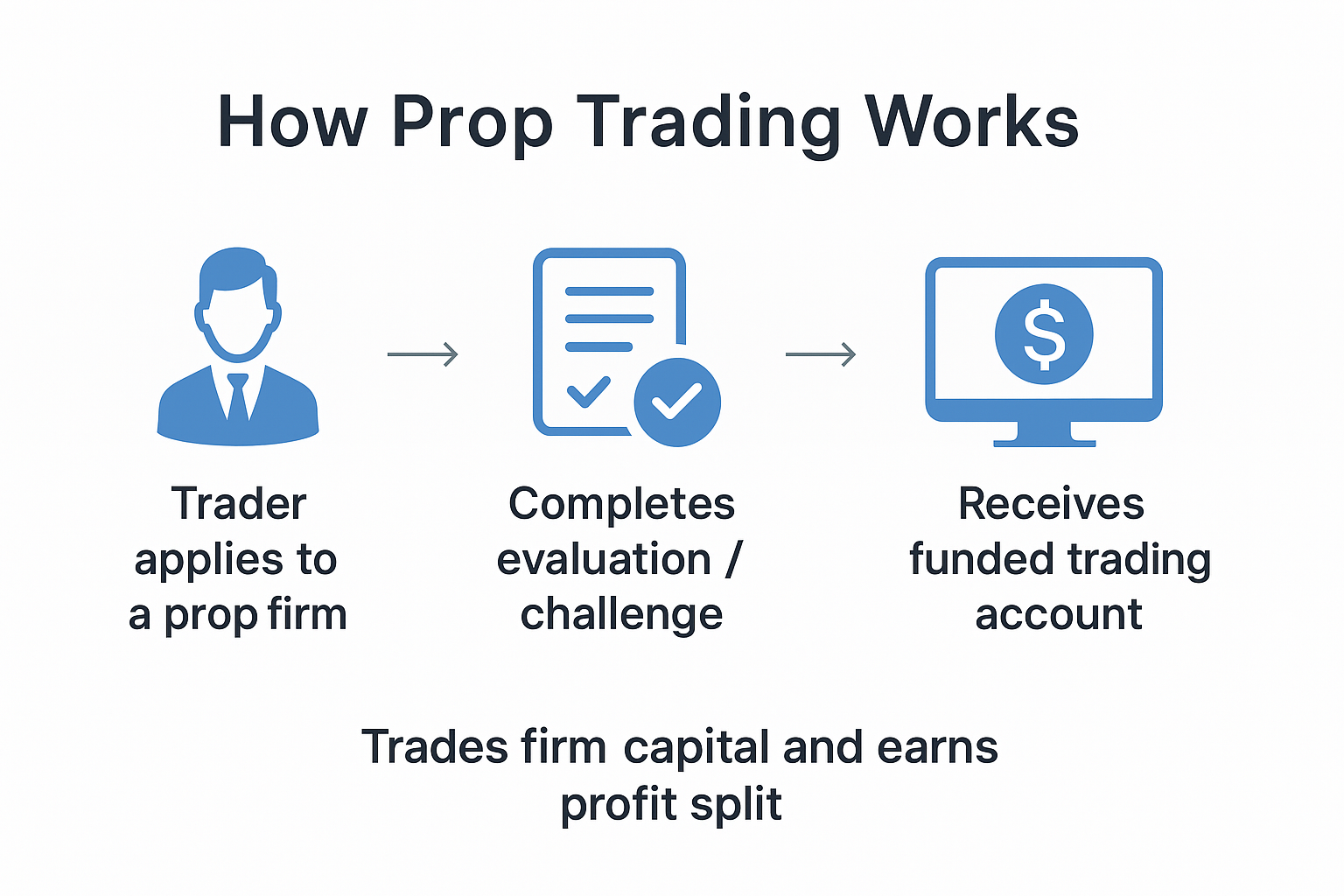

This diagram shows the typical steps traders follow to qualify for a funded prop trading account.

This diagram shows the typical steps traders follow to qualify for a funded prop trading account.Before receiving a funded account, traders are required to pass an evaluation or “challenge.” This is designed to show that the trader can manage risk, follow rules, and trade consistently.

A typical evaluation includes:

- A profit target to reach

- Maximum daily and overall drawdown limits

- Risk management rules

- Trading within defined conditions

Once the evaluation is passed, the trader is given access to a funded account. From there, profits are split between the trader and the firm according to the firm’s payout structure.

Why Do Prop Firms Use Challenges?

Challenges are not there to make trading harder — they exist to protect the firm’s capital.

Prop firms fund thousands of traders worldwide. Without strict risk controls, the business model would not be sustainable. The evaluation phase helps filter out traders who take excessive risk or trade without discipline.

For traders who already follow solid risk management, these rules often align closely with how they trade anyway.

What Are the Benefits of Prop Trading?

Prop trading appeals to traders for several reasons:

- Access to larger trading capital

- Limited personal financial risk

- Clear risk parameters

- Performance‑based rewards

- The ability to scale account size over time

For traders who struggle to grow a small personal account, prop trading can remove that limitation.

Are Prop Trading Firms Legit?

Like any industry, there are good firms and bad ones.

Reputable prop trading firms:

- Pay traders consistently

- Publish clear rules

- Offer transparent profit splits

- Have a track record of funded traders

Traders should always read the rules carefully and avoid firms that make unrealistic promises or hide key conditions.

Best Prop Trading Firms for Funded Accounts

Below are three well‑known prop trading firms that many traders consider when looking for funded trading opportunities.

Each firm has its own structure, strengths, and trading conditions.

FundedNext

FundedNext is known for offering flexible evaluation models and high-performance reward potential.

Key features:

- Up to 95% performance reward

- Multiple evaluation options

- No strict time limits on many accounts

- Suitable for traders who prefer flexibility

Learn more about FundedNext and funded trading opportunities.

SabioTrade

SabioTrade focuses on structured evaluations and disciplined trading conditions.

Key features:

- Up to 95% profit split

- Clear trading rules

- Emphasis on consistency

- Well suited to methodical traders

View SabioTrade’s funded trading program.

FTMO

FTMO is one of the longest‑established prop trading firms in the industry.

Key features:

- Up to 90% profit split

- Well‑defined evaluation process

- Strong reputation

- Popular with experienced traders

Explore FTMO’s funding challenge.

Which Prop Trading Firm Is Best?

There is no single “best” prop trading firm for everyone.

The right choice depends on:

- Trading style

- Risk tolerance

- Preference for structure or flexibility

- Experience level

Understanding how prop trading works is the first step. From there, traders can choose a firm that aligns with how they already trade.

Is Prop Trading Right for You?

Prop trading is not suitable for every trader, and it’s important to understand where it fits within your overall trading journey.

Traders who benefit most from prop trading are those who already have a proven strategy and understand risk management. Because prop firms enforce strict drawdown rules, emotional or impulsive trading often leads to failure during the evaluation phase.

Prop trading may be a good fit if you:

- Can trade consistently over time

- Follow predefined risk rules

- Are comfortable trading under structured conditions

- Want access to larger capital without risking personal funds

On the other hand, traders who frequently change strategies, over‑leverage positions, or struggle with discipline may find prop firm challenges difficult.

It’s also worth remembering that prop trading is a performance‑based model. Passing an evaluation does not guarantee long‑term success — ongoing discipline and consistency are required to maintain a funded account.

For many traders, prop trading works best as a steppingstone. It allows traders to build experience, confidence, and capital while operating within professional risk limits.

Final Thoughts on Prop Trading

For traders still asking what is prop trading, the answer lies in disciplined trading, risk control, and earning access to capital through performance.

Prop trading is not a shortcut to easy profits, but it can be a powerful tool for disciplined traders.

By trading with firm capital instead of personal funds, traders can focus on execution and risk management rather than account size. For those willing to follow the rules and trade consistently, prop trading offers a realistic path to funded trading.